Category /

Presentation

reverse mortgage loan-sorting algorithm for Mr. Cooper

reverse mortgage loan-sorting algorithm for Mr. Cooper

reverse mortgage loan-sorting algorithm for Mr. Cooper

Coordinated 0 to 1 Product Discovery to MVP to help Mr. Cooper specialists better manage their time and attention to reduce expensive loss due to delayed, late, or incorrect loan package HUD submissions

Single-handedly facilitated an entire client kickoff and discovery process to onboard/train four new product management, design, and engineering consultants alongside five client team members

Facilitated 15+ stakeholder and loan specialist interviews to gather insights about loan submission packages, processes, and government rules to understand/map current state

Conducted Design Studio workshop activities to explore ways to make it easier for specialists to know which loan packages require attention and why

Validated key feature assumptions with clickable prototypes in 10 usability tests with loan specialists to inform useful and delightful priorities for initial MVP workflow

Crafted outcome-based roadmap for task prioritization algorithm with real-time updates, critical document date management and custom reminders to increase the frequency of complete loan package submission, increase HUD package acceptance (decrease denials) and reduce loss

users: final loan package review specialists

problem: curating 50+ time-sensitive regulatory PDFs for ~100 loans/person to submit to the government is a time-consuming, mundane & error-prone process, and the existing tools made prioritizing work a guessing game

goal: increase loan package accuracy and speed to submission, leading to less crossover loss due to MCA%

specialist outcomes:

know exactly which required elements of which loans need their attention first

view and verify existing documents available to “work” for new loan assignments

avoid reworking the same documents once they’re marked valid

track and manage time-sensitive dates along with follow-up dates for external document curation dependencies

product features:

loan package exception-level prioritization queue

pdf preview & match to required document types

government package criteria validation & expiration date tracking

lesson learned:

it can be difficult to shift user mindset away from what they’re used to, even in an effort to streamline their day-to-day activities

Coordinated 0 to 1 Product Discovery to MVP to help Mr. Cooper specialists better manage their time and attention to reduce expensive loss due to delayed, late, or incorrect loan package HUD submissions

Single-handedly facilitated an entire client kickoff and discovery process to onboard/train four new product management, design, and engineering consultants alongside five client team members

Facilitated 15+ stakeholder and loan specialist interviews to gather insights about loan submission packages, processes, and government rules to understand/map current state

Conducted Design Studio workshop activities to explore ways to make it easier for specialists to know which loan packages require attention and why

Validated key feature assumptions with clickable prototypes in 10 usability tests with loan specialists to inform useful and delightful priorities for initial MVP workflow

Crafted outcome-based roadmap for task prioritization algorithm with real-time updates, critical document date management and custom reminders to increase the frequency of complete loan package submission, increase HUD package acceptance (decrease denials) and reduce loss

users: final loan package review specialists

problem: curating 50+ time-sensitive regulatory PDFs for ~100 loans/person to submit to the government is a time-consuming, mundane & error-prone process, and the existing tools made prioritizing work a guessing game

goal: increase loan package accuracy and speed to submission, leading to less crossover loss due to MCA%

specialist outcomes:

know exactly which required elements of which loans need their attention first

view and verify existing documents available to “work” for new loan assignments

avoid reworking the same documents once they’re marked valid

track and manage time-sensitive dates along with follow-up dates for external document curation dependencies

product features:

loan package exception-level prioritization queue

pdf preview & match to required document types

government package criteria validation & expiration date tracking

lesson learned:

it can be difficult to shift user mindset away from what they’re used to, even in an effort to streamline their day-to-day activities

Coordinated 0 to 1 Product Discovery to MVP to help Mr. Cooper specialists better manage their time and attention to reduce expensive loss due to delayed, late, or incorrect loan package HUD submissions

Single-handedly facilitated an entire client kickoff and discovery process to onboard/train four new product management, design, and engineering consultants alongside five client team members

Facilitated 15+ stakeholder and loan specialist interviews to gather insights about loan submission packages, processes, and government rules to understand/map current state

Conducted Design Studio workshop activities to explore ways to make it easier for specialists to know which loan packages require attention and why

Validated key feature assumptions with clickable prototypes in 10 usability tests with loan specialists to inform useful and delightful priorities for initial MVP workflow

Crafted outcome-based roadmap for task prioritization algorithm with real-time updates, critical document date management and custom reminders to increase the frequency of complete loan package submission, increase HUD package acceptance (decrease denials) and reduce loss

users: final loan package review specialists

problem: curating 50+ time-sensitive regulatory PDFs for ~100 loans/person to submit to the government is a time-consuming, mundane & error-prone process, and the existing tools made prioritizing work a guessing game

goal: increase loan package accuracy and speed to submission, leading to less crossover loss due to MCA%

specialist outcomes:

know exactly which required elements of which loans need their attention first

view and verify existing documents available to “work” for new loan assignments

avoid reworking the same documents once they’re marked valid

track and manage time-sensitive dates along with follow-up dates for external document curation dependencies

product features:

loan package exception-level prioritization queue

pdf preview & match to required document types

government package criteria validation & expiration date tracking

lesson learned:

it can be difficult to shift user mindset away from what they’re used to, even in an effort to streamline their day-to-day activities

Client:

Client:

Client:

Year:

2018

Year:

2018

Year:

2018

Role:

Product Management Consultant

Role:

Product Management Consultant

Role:

Product Management Consultant

selected works

Other interesting work

engaging UX for B-seeking companies that prioritize people and planet

2020-2021

engaging UX for B-seeking companies that prioritize people and planet

2020-2021

engaging UX for B-seeking companies that prioritize people and planet

2020-2021

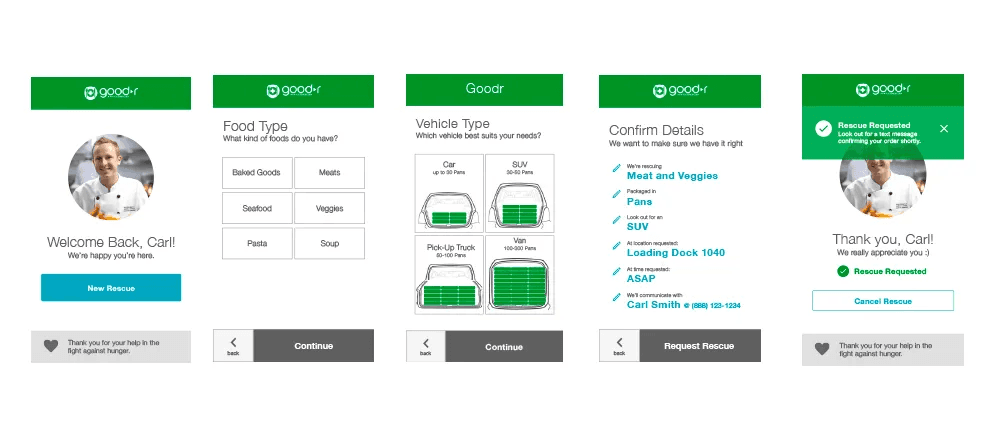

startup design sprint: leftover food donation pickup

2017

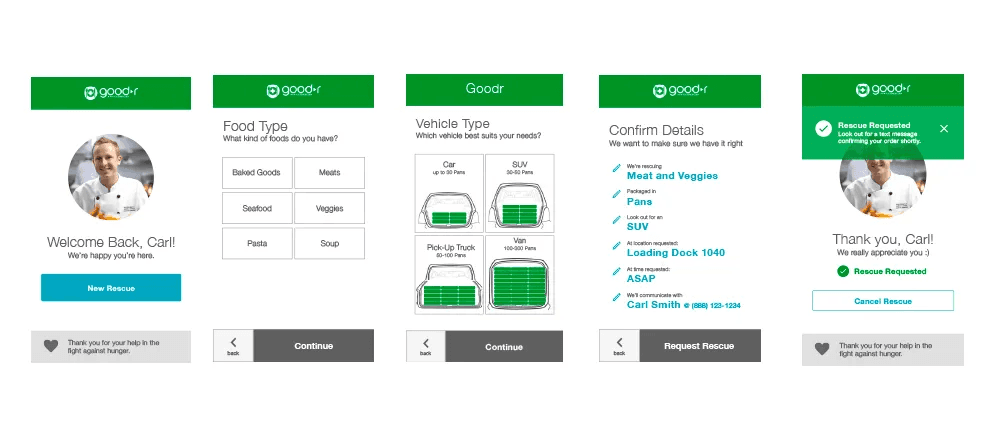

startup design sprint: leftover food donation pickup

2017

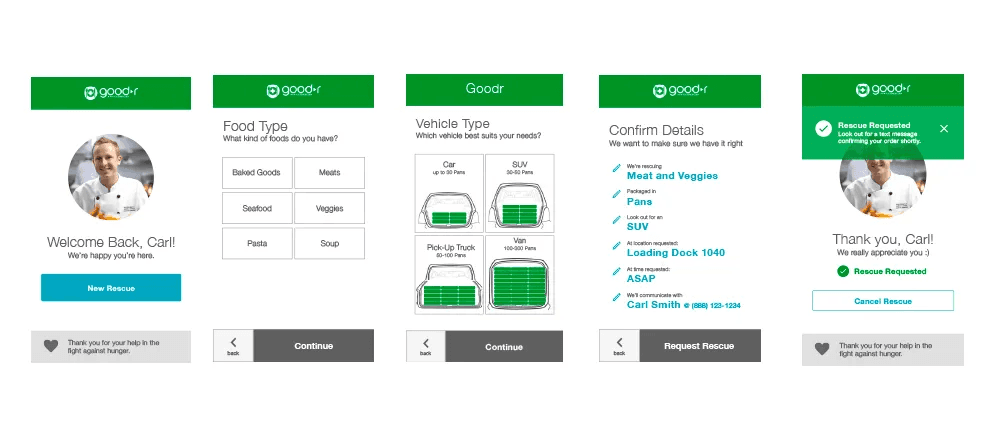

startup design sprint: leftover food donation pickup

2017